Who is targeted?

Category: General

In our first post about overpayments, we described how an overpayment can happen from a provider point of view. Now, let’s look at what happens from an industry point of view, specifically Medicare overpayments. While there are differences between sectors, there are some commonalities and the statistics are staggering.

The chart below shows the results of a CERT report on improper payments in FY 2015 (July 1, 2013 – June 30 2014) and is available on CMS’s website. The objective of the CERT program is to estimate the accuracy of the Medicare Fee-for-Service (FFS) program, but it also provides insight into the amount of overpayments, also known as “improper payments.”

| Service Type | Improper Payment Rate | Improper Payment Amount |

|---|---|---|

| Inpatient Hospitals | 6.2% | $7.0B |

| Durable Medical Equipment | 39.9% | $3.2B |

| Physician/Lab/Ambulance | 12.7% | $11.5B |

| Non-inpatient Hospital Facilities | 14.7% | $21.7B |

| OVERALL | 12.1% | $43.3B |

This chart is really fascinating. There is big variation between sectors with regard to the improper payment rate – especially if you look at DME as an outlier here with nearly 40% of payments being deemed improper. But when you get to the improper payment amount, you see a different pattern emerging. DME is still an outlier, but for having a much lower amount. This means that CMS shows that they were able to identify what they deem an “improper payment” many more times for DME providers, but it must be a lot of smaller transactions. If you think about a lot of the items that are covered by DME, which can be smaller ticket items such as bandages or compression stockings, it makes sense.

For DME providers this means that there are a lot of overpayments being identified for small amounts – creating a lot of work to stay on top of tracking and ensuring repayment. This means that there is a very high labor cost of managing tracking these overpayments. And overpayments is a cost center – so this is a huge hit to your bottom line.

For other sectors the story may be different, but it’s not much brighter. For example, if you look at the Lab and Ambulance providers – they have nearly 13% improper payment rate and nearly 11.5 billion dollars in the total amount – over 3.5 times the amount for DME. In this sector, each overpayment is likely for a much larger amount, meaning the stakes on each line item are much higher. You have to pay it back in 30 days and it can be a big hit on cash flow. Not staying on top of it could result in high fines.

CMS uses Recovery Audit Contractors (RACs) to look for both overpayments and underpayments. RACs are paid on contingency, meaning they get paid a percentage of what they find. This is unlike the MACs who are paid a retainer fee, so they are theoretically not motivated to audit.

There are some small checks and balances. For example: because RACs are also looking for underpayments, and they are paid on cases where CMS has to give providers additional funds, they should theoretically be neutral parties. However – with overpayments, it is a "guilty until proven innocent" situation and the burden of proof and evidence is on the hands of the provider. In 2013, RACs reported $3.65 billion in overpayments collected and a mere $102.4 million in underpayments repaid to providers and suppliers. Clearly the stakes are not even.

There is a mandate for RACs to maintain an accuracy rate of at least 95 percent. If they don’t, their ability to issue Additional Documentation Requests becomes hindered (and therefore hinder their ability to identify overpayments or missing documentation and get their contingency fee.)

All it takes is one piece of missing documentation, and even if you deserve the payment, it will be deemed an “improper payment” and the money will be demanded back.

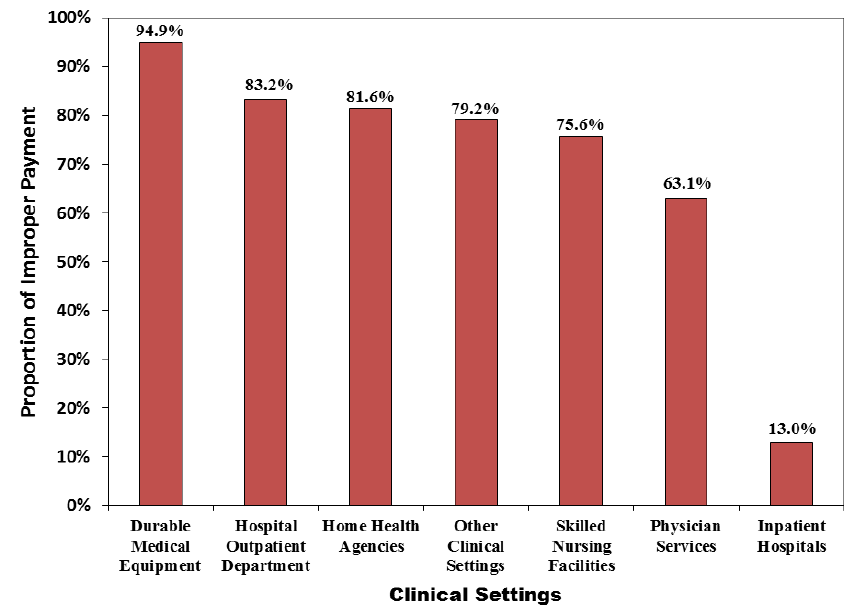

This chart is from a report on improper payments that Medicare published in 2013, and it shows the proportion of improper payments attributed to insufficient documentation in 2013, by clinical setting. (Medicare Fee-for-Service 2013 Improper Payments Report.) Three years beyond the exact numbers may be different, but the general theme is the same: insufficient documentation is a key culprit in how CMS determines what is improper. You might deserve the money – you may have done the work and supplied the product and it was wanted and necessary, but if you don’t have every single duck in a row – CMS is going to exploit that to be able to take back money. Medicare’s goal is to minimize expenditure and missing documentation is the easiest way to do so. Durable Medical Equipment providers are particularly at risk because the documentation burdens are much higher in that sector – although all post-acute providers have elevated risk.

Documentation burdens are higher in healthcare than ever before and missing documentation makes you a prime target. Without complete documentation you cannot prove without a doubt that there was medical necessity, even for something as simple as a missing date on a signature.

This chart really underlines the importance of document management and process management to ensure you always have an absolutely clean and fully-supported claim submitted. Or, if you are accused of having received an overpayment, you can have documentation at your fingertips to quickly file an appeal on the overpayment with sufficient proof that you deserve that payment.

To learn more about Medforce’s document management program, ContentCenter, click here. To learn more about Medforce’s Overpayments & Refund Management App, click here, watch our recorded webinar in the Library, or request a live demo.

To learn more or request a demonstration of what Medforce software can do for you fill in this form or call our sales department at:

Even our demos let you preview without leaving your desk. View the power of Medforce right from the comfort of your office.